تاريخ الرياضيات

تاريخ الرياضيات

الرياضيات في الحضارات المختلفة

الرياضيات في الحضارات المختلفة

الرياضيات المتقطعة

الرياضيات المتقطعة

الجبر

الجبر

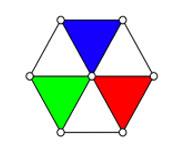

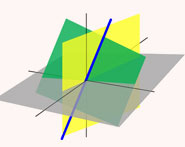

الهندسة

الهندسة

المعادلات التفاضلية و التكاملية

المعادلات التفاضلية و التكاملية

التحليل

التحليل

علماء الرياضيات

علماء الرياضيات |

Read More

Date: 26-8-2021

Date: 11-2-2016

Date: 18-12-2021

|

Black-Scholes theory is the theory underlying financial derivatives which involves stochastic calculus and assumes an uncorrelated log normal distribution of continuously varying prices. A simplified "binomial" version of the theory was subsequently developed by Sharpe et al. (1998) and Cox et al. (1979). It reproduces many results of the full-blown theory, and allows approximation of options for which analytic solutions are not known (Price 1996).

REFERENCES:

Black, F. and Scholes, M. S. "The Pricing of Options and Corporate Liabilities." J. Political Econ. 81, 637-659, 1973.

Cox, J. C.; Ross, A.; and Rubenstein, M. "Option Pricing: A Simplified Approach." J. Financial Economics 7, 229-263, 1979.

Price, J. F. "Optional Mathematics is Not Optional." Not. Amer. Math. Soc. 43, 964-971, 1996.

Sharpe, W. F.; Alexander, G. J.; Bailey, J. V.; and Sharpe, W. C. Investments, 6th ed. Englewood Cliffs, NJ: Prentice-Hall, 1998.

|

|

|

|

"إنقاص الوزن".. مشروب تقليدي قد يتفوق على حقن "أوزيمبيك"

|

|

|

|

|

|

|

الصين تحقق اختراقا بطائرة مسيرة مزودة بالذكاء الاصطناعي

|

|

|

|

|

|

|

قسم شؤون المعارف ووفد من جامعة البصرة يبحثان سبل تعزيز التعاون المشترك

|

|

|